The Hidden Price of Pennies: Why Cost-Cutting in Security Is the Riskiest Line Item for C-Suites

When CFOs trim security to hit quarterly targets, they’re often betting on luck — not resilience. Real-world data shows that security reductions rarely save money; they merely postpone loss.

- Introduction – The Illusion of Savings

- Quick Summary / Key Takeaways

- 1. The Economic Context: Why Security Budgets Are Under Fire

- 2. Case Studies — When Cost Cutting Became Catastrophic

- 3. The Hidden Costs Executives Overlook

- 4. The Leadership Mindset Shift

- 5. Quantifying the Risk – CFO Framework

- 6. The Reverse-Psychology View — “What If We Don’t?”

- 7. How ArcadianAI Ranger Changes the Equation

- 8. Industry Comparison — Who Pays More for Less

- 9. Lessons from the Field

- 10. Governance, Compliance, and Trust

- 11. Future Outlook — The Economics of Intelligent Risk

- Common Questions (FAQ)

- Conclusion & Executive Call to Action

- Security Glossary (2025 Edition)

Introduction – The Illusion of Savings

Every executive knows the pressure: quarterly numbers, shareholder calls, margin compression. In those meetings, security looks like an easy line to trim — non-revenue, hard to measure, and rarely celebrated when things go right. Yet when things go wrong, those same line items turn into board-level crises.

ArcadianAI’s research and field partnerships across North America reveal a recurring pattern: organizations that cut or freeze security budgets to “save” 3–5 percent of operating expenses typically lose 8–15 percent more in shrink, insurance premiums, or litigation within a single fiscal year.

From Walmart’s 2023 decision to increase its loss-prevention spend after a year of record shrink, to Walgreens’ store-closure dilemma in San Francisco, the message is consistent: security isn’t a sunk cost — it’s deferred profit protection.

Quick Summary / Key Takeaways

-

Budget cuts in security create delayed, compounding financial risks.

-

Retail shrink has doubled since 2019 across North America.

-

False alarms and inefficient systems drain millions in hidden OPEX.

-

Strategic, AI-driven security delivers measurable ROI within months.

-

ArcadianAI Ranger turns video data into financial insight — protecting both people and profit.

1. The Economic Context: Why Security Budgets Are Under Fire

1.1 Margin Pressure Meets Risk Inflation

Inflation, wage growth, and energy costs forced CFOs to re-prioritize efficiency in 2024–2025. In many industries, “efficiency” became synonymous with “cut.” Yet risk inflation — the rise in theft, fraud, and cyber-physical incidents — outpaced those savings.

According to the National Retail Federation, organized retail crime and internal theft cost U.S. retailers over $112 billion in 2023, a 19 percent year-over-year increase. Canada and the U.K. reported similar surges.

When executives cut security, they aren’t trimming waste — they’re trimming the very layer that keeps those inflationary risks from hitting EBITDA.

1.2 The Psychology of the Budget Knife

Behavioral economics explains why C-suites make this mistake:

-

Availability bias: because major incidents are rare, leaders underestimate their probability.

-

Loss aversion: executives prefer the guaranteed short-term saving of $1 million over the probabilistic avoidance of a $5 million loss.

-

Attribution illusion: when nothing bad happens post-cut, leaders credit discipline rather than luck — until the next incident reverses perception.

As Rory Sutherland put it: “The opposite of a good idea can also be a good idea.” In security, the opposite of “cut” is often “save.”

2. Case Studies — When Cost Cutting Became Catastrophic

2.1 Walmart: From Cost Discipline to Data-Driven Reinforcement

Walmart initially attempted to control OPEX by limiting on-site security labor and delaying camera upgrades in select regions. The result? Shrink rates reached 2 percent of revenue, translating to over $3 billion in losses. By 2024, Walmart reversed course, expanding AI-driven loss-prevention investments and publicly linking them to improved profit margins.

2.2 Walgreens: The Store-Closure Paradox

In 2022, Walgreens cited “organized retail crime” as a reason for closing multiple San Francisco stores. Later reviews revealed security spending cuts and inconsistent technology integration — decisions made to preserve short-term cost targets. The closures saved OPEX but sacrificed market share, goodwill, and employee safety.

2.3 Tesco and U.K. Grocers: False Economy of Under-Surveillance

U.K. grocers that reduced manned security to offset energy-cost spikes saw theft rise by 30 percent within six months. Re-staffing later cost 1.8× the original savings.

3. The Hidden Costs Executives Overlook

| Category | How It Appears | Financial Translation |

|---|---|---|

| Insurance premiums | Increased claims after incidents | +8–12 % annual cost |

| Employee turnover | Fear & burnout in high-risk stores | Recruiting + training = $4 000–$8 000 per hire |

| Litigation | Liability for unsafe environments | Settlements $100K – $5M |

| Operational downtime | Investigations & police reports | Lost revenue days |

| Brand damage | Viral videos, news coverage | Unquantifiable long-tail loss |

Each “hidden” category compounds the others, turning a 3 percent budget trim into a 10–15 percent total cost-of-risk escalation.

4. The Leadership Mindset Shift

4.1 From Compliance to Competitiveness

Executives traditionally framed security as compliance — something to maintain. Modern leaders see it as competitive resilience: faster detection, better data for insurers, and lower churn among staff and customers who feel safer.

4.2 From Visibility to Insight

Legacy NVR systems provide visibility; AI-driven cloud platforms like ArcadianAI’s Ranger deliver context — linking video events with POS, payment, and environmental data. Visibility without context is overhead; context creates decisions.

4.3 From Cost Center to Value Driver

Security spend should appear in ROI dashboards alongside marketing and operations. CFOs who run security as a value function report higher asset-recovery ratios and lower insurance deductibles.

5. Quantifying the Risk – CFO Framework

Scenario 1: 100-Store Retail Chain

| Metric | Value |

|---|---|

| Average monthly shrink per store | $7 500 |

| Annual shrink loss | $9 million |

| Ranger deployment cost | $250 / store / month = $300K / year |

| Expected shrink reduction | 25 % (industry benchmark) |

| Annual savings | $2.25 million |

| Net ROI | 6.5× return within 12 months |

Scenario 2: 500-Location Enterprise

| Metric | Value |

|---|---|

| Annual shrink loss | $45 million |

| Ranger rollout cost | $1.5 million |

| Shrink reduction (conservative 20 %) | $9 million |

| ROI | 5×, plus intangible benefits (compliance, morale, insurance leverage) |

6. The Reverse-Psychology View — “What If We Don’t?”

Executives respond strongly to regret aversion. So flip the mental model: instead of asking “How much will this cost us to implement?”, ask “How much will it cost us not to?”

Every quarter without modern AI surveillance, organizations accumulate:

-

Unverified incidents

-

Wasted responder hours

-

Litigation risk

-

Insurance penalties

-

Cultural erosion (“no one cares” effect)

In behavioral terms, cost cutting in security is intertemporal discounting — valuing immediate gains over future stability. In financial terms, it’s paying compound interest on risk.

7. How ArcadianAI Ranger Changes the Equation

7.1 Scene-Aware Intelligence

Ranger’s multi-modal AI analyzes human, vehicle, and object behavior — not just detection — cutting false positives by up to 90 percent.

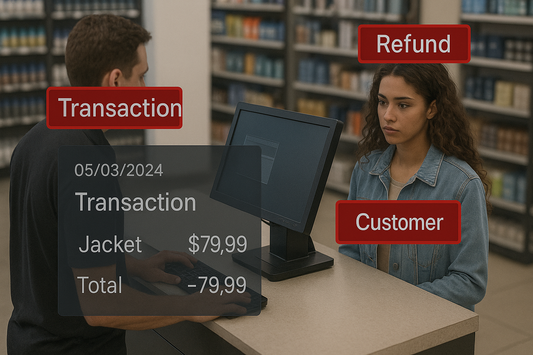

7.2 POS + Payment Integration

Ranger correlates transaction anomalies with live video: voided sales, refunds, or high-value item removals instantly flag correlated footage.

7.3 Open Architecture

Unlike closed systems (Verkada, Genetec, Milestone), Ranger integrates via open API, allowing enterprises to link HR, ERP, and incident-management systems.

7.4 Rapid ROI

Most clients reach break-even in under three months. The cost savings manifest in fewer false alarms, faster investigations, and measurable shrink reduction.

8. Industry Comparison — Who Pays More for Less

| Feature | Verkada | Eagle Eye | Genetec | Milestone | ArcadianAI Ranger |

|---|---|---|---|---|---|

| Cloud Native | Partial | Full | No | Partial | Full (Cloud + Edge) |

| POS Integration | Limited | Manual | Third-party | None | Native Real-Time API |

| Contextual AI | Object only | Basic | Limited | None | Scene + Behavior Aware |

| ROI Timeline | 12 mo+ | 9–12 mo | 12–18 mo | 12 mo | < 3 mo |

| Camera Lock-In | Yes | No | No | No | No Lock-In (agnostic) |

9. Lessons from the Field

Retail

Chains that paired ArcadianAI Ranger with existing cameras achieved up to 30 percent reduction in shrink.

Logistics & Warehousing

AI correlation of pallet movement and badge access reduced loss events by 40 percent.

Self-Storage & Construction

Adaptive analytics prevented theft and vandalism despite variable lighting and weather.

10. Governance, Compliance, and Trust

Security modernization isn’t just about machines — it’s about governance.

Ranger embeds:

-

NDAA-compliant architecture (no restricted hardware)

-

GDPR & PIPEDA privacy safeguards

-

Audit trails for every alert and action

-

API transparency for third-party verification

Executives can demonstrate due diligence to insurers and regulators — turning compliance into leverage.

11. Future Outlook — The Economics of Intelligent Risk

By 2027, Gartner forecasts that over 60 percent of physical-security data will be analyzed by AI systems rather than humans. The winners won’t be those who spent less — but those who spent smarter, turning risk data into predictive insight.

Security will merge with finance dashboards, showing loss prevention as a live KPI alongside revenue per square foot. ArcadianAI’s roadmap aligns precisely with that convergence: integrating Ranger data into BI tools like Power BI and Tableau for unified operational intelligence.

Common Questions (FAQ)

Q1: How can we justify security spend to the board?

Show ROI, not fear. Use shrink recovery, insurance premium reductions, and false-alarm savings as quantifiable metrics.

Q2: What’s the first step without major capital?

Deploy Ranger in high-risk zones. Measure ROI within 90 days before scaling.

Q3: How does ArcadianAI integrate with existing infrastructure?

Ranger is camera-agnostic and API-friendly. No rip-and-replace; connect through Bridge or secure RTSP onboarding.

Q4: What about data privacy and compliance?

Fully NDAA-compliant, GDPR/PIPEDA-aligned, with anonymization and access control built in.

Q5: How does AI reduce false positives?

By analyzing context — motion, behavior, and transaction data — rather than static object detection alone.

Conclusion & Executive Call to Action

Every CFO faces a choice between short-term appearance and long-term resilience. Cutting security budgets may balance spreadsheets, but it unbalances risk.

ArcadianAI enables leaders to treat security as an investment class — measurable, defensible, and profit-protective. The organizations that thrive in the 2025 economy will be those that use intelligence to reduce uncertainty, not those that outsource risk to luck.

Get Your Personalized ROI Report → Get Demo – ArcadianAI

Internal Links

-

[Inside Walmart’s War on Retail Crime →]

-

[Why NVRs Are Dying: The Hidden Cost of Legacy Surveillance →]

-

[Loss Prevention in North America: The Case for POS-Aware Video AI →]

External References

-

National Retail Federation (2024 Retail Shrink Report)

-

FBI Uniform Crime Statistics (2024)

-

Security Magazine Budget Outlook 2025

-

Gartner Physical Security Forecast 2025

-

CentralSquare Public Safety False Alarm Study

Security Glossary (2025 Edition)

AI Alerts — Automated notifications generated when the AI detects anomalies or threats.

Behavioral Analytics — Machine-learning models interpreting actions rather than static objects.

False Positive — Incorrect detection of a threat; a leading driver of wasted OPEX.

Loss Prevention ( LP ) — Strategies and technologies minimizing retail shrink.

NDAA Compliance — U.S. standard banning restricted foreign hardware from federal networks.

NVR (Network Video Recorder) — Local device storing IP camera footage; being replaced by cloud VSaaS.

Organized Retail Crime ( ORC ) — Coordinated theft targeting high-value retail goods.

POS-Aware Video AI — Integration of point-of-sale data with video analytics for transaction validation.

Ranger ( ArcadianAI ) — Cloud-native, camera-agnostic AI platform for contextual surveillance intelligence.

ROI (Return on Investment) — Financial ratio comparing savings or revenue gain to cost of deployment.

Scene-Aware AI — Analytics that understand context — distinguishing theft from normal motion.

Shrink — Inventory or asset loss from theft, fraud, or error.

TCO (Total Cost of Ownership) — Aggregate cost including maintenance, labor, and losses avoided.

VSaaS (Video Surveillance as a Service) — Subscription-based cloud video management and analytics.

Audit Trail — Tamper-proof log of alerts and actions for compliance verification.

Bridge Device — ArcadianAI hardware interface for secure onboarding of legacy cameras.

Security is like insurance—until you need it, you don’t think about it.

But when something goes wrong? Break-ins, theft, liability claims—suddenly, it’s all you think about.

ArcadianAI upgrades your security to the AI era—no new hardware, no sky-high costs, just smart protection that works.

→ Stop security incidents before they happen

→ Cut security costs without cutting corners

→ Run your business without the worry

Because the best security isn’t reactive—it’s proactive.