When Your Loss Prevention System Teaches Criminals How to Win: The Case for POS-Aware Video AI

Your loss prevention tools might be giving criminals a playbook. Here’s how POS-aware AI flips the advantage — and why ArcadianAI Ranger is the bridge between video, payments, and profit protection.

- Introduction

- Quick Summary / Key Takeaways

- Background & Relevance

- Why Traditional Loss Prevention Fails in 2025

- The New Model: POS-Aware Loss Prevention

- Reverse Psychology Moment: What If You Don’t Act?

- The Data Behind the Pain

- How ArcadianAI Ranger Rewrites the Playbook

- Competitor Comparison: ArcadianAI vs. Legacy Players

- Real-World Scenarios

- The Partner Opportunity

- Common Questions (FAQ)

- Conclusion & Call to Action

- Security Glossary (2025 Edition)

Introduction

Every retailer believes their loss prevention (LP) system protects them — until it doesn’t.

Because in 2025, criminals don’t “steal.” They engineer losses.

They test refund limits, exploit POS loopholes, abuse digital wallets, and manipulate payment delays faster than traditional LP tools can respond. While your team watches yesterday’s footage, organized retail crime (ORC) syndicates run playbooks tested in hundreds of stores across North America.

ArcadianAI’s Ranger platform connects POS data, payment signals, and live video AI to close those gaps — not by catching thieves, but by predicting behaviors before loss becomes measurable.

Legacy platforms like Verkada, Genetec, or Eagle Eye Networks offer partial integrations and sleek dashboards. But ask yourself: how many refunds did you stop last quarter because of context-aware video intelligence? If the answer is “none,” your security stack might be teaching criminals what works.

Quick Summary / Key Takeaways

-

POS, payment, and video AI silos make loss prevention reactive

-

ORC losses in North America exceed $112 billion annually

-

Friendly fraud and refund abuse are rising faster than theft

-

POS-aware AI enables contextual, transaction-linked intelligence

-

ArcadianAI’s Ranger unifies data — no hardware lock-in, full API openness

Background & Relevance

The retail industry has entered a phase where data is plentiful — but disconnected.

The National Retail Federation (NRF) reports shrink grew from $93.9 billion in 2021 to $112.1 billion in 2024, an all-time high. Over 80% of retail executives cite organized crime, employee collusion, and refund abuse as top threats.

Yet, 60% still rely on outdated, camera-only VMS (video management systems) with no connection to POS or payments. That’s like hiring a guard who never checks the cash register.

The convergence of video AI + POS + payments intelligence is no longer experimental — it’s existential.

Why Traditional Loss Prevention Fails in 2025

1. “After-the-fact” security is security theater

Traditional VMS/NVR systems analyze video after incidents. But loss prevention is no longer about catching theft — it’s about preventing fraud patterns.

By the time a manager reviews a refund clip, the same tactic has been replicated in 50 stores.

2. Fragmented data = perfect camouflage

Video sees motion. POS sees transactions. Payments see risk. None talk to each other.

That isolation makes fraud statistically invisible — a flaw ORC networks exploit deliberately.

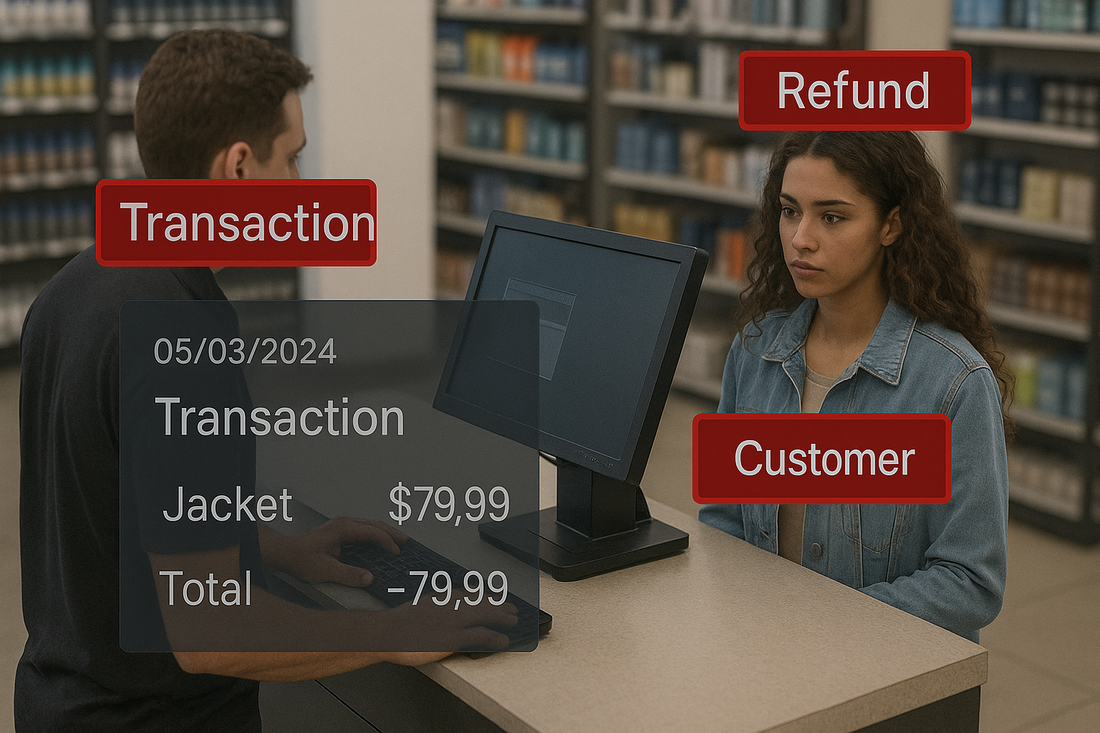

3. POS data without video context = false suspicion

A suspicious void at the till may be a policy fix, not fraud. Without seeing the scene, you punish loyal staff. That’s why most retailers still under-investigate — they fear false positives more than actual losses.

4. The reverse psychology trap: comfort equals vulnerability

If your LP reports say “losses are stable,” you’re in danger. Stability in shrink is rarely victory — it means your systems are blind to evolving tactics.

The New Model: POS-Aware Loss Prevention

What It Means

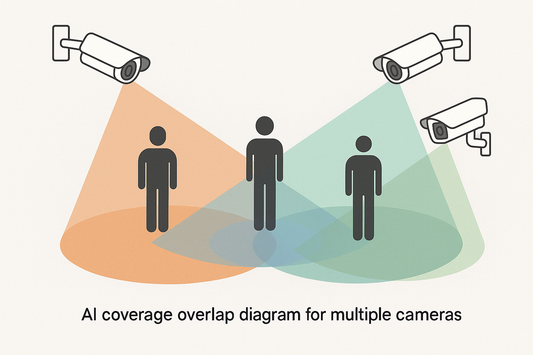

POS-aware loss prevention fuses three intelligence layers:

| Layer | Function | Example |

|---|---|---|

| POS Data | Transaction, void, discount, refund | “$89 refund without receipt” |

| Video AI | Visual confirmation, object tracking | “No item returned at counter” |

| Payment Data | Card ID, token, velocity, location | “Same card used in 3 stores” |

Together, they create a behavioral fingerprint — far stronger than any single data point.

What It Solves

-

Refund fraud — detect mismatched transactions vs. video context

-

Sweethearting — spot missing scan motions or concealment

-

ORC network detection — correlate store IDs, payment tokens, and travel routes

-

False accusation prevention — contextual proof before HR or legal escalation

What It Enables

-

Instant investigation (“Click transaction → view event clip”)

-

80–90% reduction in manual review time

-

50–70% decrease in refund abuse within 90 days

-

Full integration with POS and payments partners via ArcadianAI API

Reverse Psychology Moment: What If You Don’t Act?

If your POS, payments, and LP teams aren’t integrated, congratulations — you’ve created an R&D sandbox for criminals. They’ll use your own systems to refine their playbooks.

Every disconnected dataset helps them calculate your detection delay.

Every false alarm teaches them which patterns your system ignores.

Every refund you skip reviewing confirms which loopholes are safe.

Doing nothing isn’t neutral — it’s training the opposition.

The Data Behind the Pain

| Stat | Source | Impact |

|---|---|---|

| 42% of North American retailers report internal collusion in refund abuse | NRF 2024 | POS-linked AI analytics reduce inside jobs by pattern matching cashier IDs |

| 64% of retailers now face “friendly fraud” from loyalty abuse and partial returns | Forter Fraud Index 2024 | AI-video correlation identifies absent-item returns |

| $107 B projected annual global payment fraud by 2029 | Juniper Research | Context-driven LP lowers false positives and chargeback volume |

| 80% of merchants can’t correlate refund data with video evidence | Visa Fraud Report 2025 | ArcadianAI solves this through camera-agnostic ingestion |

| Average investigation time for a refund dispute: 48 hours | NRF LP Council | POS-aware video AI cuts it to under 5 minutes |

How ArcadianAI Ranger Rewrites the Playbook

1. Contextual Awareness

Ranger doesn’t just detect — it interprets. It reads transactions, visual cues, and temporal patterns to identify intent. That’s the difference between “motion detection” and “behavior understanding.”

2. Open API for POS & Payment Platforms

ArcadianAI actively invites POS and payment companies to connect via API. Whether it’s Clover, Square, Lightspeed, Shopify POS, or Verifone — Ranger can read their events in real time.

“We don’t replace your systems. We make them smarter.”

3. Camera-Agnostic Infrastructure

Hanwha, Axis, Hikvision, Uniview, or any ONVIF source — it doesn’t matter. Ranger fuses streams into one AI layer without vendor lock-in.

4. Adaptive AI Learning

Every confirmed incident feeds Ranger’s adaptive model — distinguishing customer error from intent, and genuine risk from harmless pattern.

5. Audit-Ready Evidence

All incidents generate audit trails aligned with SOC 2, GDPR, and NDAA compliance — ready for insurers or law enforcement.

Competitor Comparison: ArcadianAI vs. Legacy Players

| Feature | Verkada | Eagle Eye | Genetec | Solink | ArcadianAI Ranger |

|---|---|---|---|---|---|

| POS Integration Depth | Basic triggers only | Manual API setup | Third-party module | Moderate integration | Full real-time POS + payment API |

| Camera Agnostic | ❌ Proprietary hardware | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes (no lock-in) |

| Contextual AI | Partial | Partial | Limited | Moderate | Scene-aware, multi-modal AI |

| API Access for Partners | Closed ecosystem | Limited | Closed | Limited | Open architecture |

| ROI Timeline | 6–12 months | ~12 months | 12–18 months | ~6 months | Under 3 months |

ArcadianAI’s edge isn’t hardware — it’s context intelligence: the ability to unify multiple truths into one decision. ArcadianAI Ranger delivers faster ROI, real-time POS + payment intelligence, and open integrations — while competitors remain siloed, hardware-locked, or API-restricted.

Real-World Scenarios

Case 1 – Refund Fraud at Scale

A retail chain notices rising refund totals but no visual theft. Ranger links POS refunds to video — reveals staff issuing false refunds to friends. Result: $180 K annual loss prevented in 30 days.

Case 2 – ORC Pattern Across States

Multiple stores show similar “customer distraction + open register” tactics. Ranger correlates vehicle plates and transaction times — identifies same group across 3 states.

Case 3 – Card Token Abuse

Payment partner data flags suspicious token velocity. Ranger overlays matching face embeddings across 2 stores. Fraudster apprehended with audit-ready evidence.

Case 4 – Sweethearting and Shrink

An employee consistently scans half the basket. POS logs look clean — but Ranger detects repetitive motion mismatches. Result: policy correction and retraining instead of wrongful termination.

The Partner Opportunity

For POS & Payment Providers

ArcadianAI isn’t competition — it’s an amplifier.

Integrating with Ranger boosts your fraud-detection metrics and enhances client retention.

Offer your merchants new value: video-verified refunds, AI-graded risk events, and contextual dashboards.

For Retailers

Every transaction tells a story. The only question: who’s reading it?

With Ranger, your LP, finance, and compliance teams share a single truth — every refund, every dispute, every moment.

For Technology Partners

We’re API-open. Provide your event schemas, we’ll align. Whether it’s card processors, mobile payments, or data analytics vendors — ArcadianAI’s Bridge and Ranger layers can integrate directly.

📩 Contact: partnership@arcadian.ai

Common Questions (FAQ)

Q1. Do I need to replace my cameras or POS?

No. ArcadianAI integrates through APIs and ONVIF streams — no hardware change required.

Q2. How fast is deployment?

Typical pilot: 3–5 days from API handshake to first correlated alerts.

Q3. Can I integrate multiple POS vendors?

Yes. Ranger’s schema supports multi-tenant, multi-POS environments.

Q4. How does it help payments companies?

By linking video to transaction metadata, you reduce false chargebacks and improve dispute outcomes.

Q5. What about privacy and compliance?

Ranger adheres to NDAA, SOC 2, GDPR, and regional privacy acts — with audit logs for every data touchpoint.

Conclusion & Call to Action

Reverse psychology for decision makers:

If your loss prevention team says “we have enough coverage,” you likely don’t. True security isn’t what you see — it’s what your systems understand together.

POS-aware video AI is the next evolution of fraud defense. It’s not a feature — it’s the difference between losing $1 million quietly or saving it confidently.

ArcadianAI is helping retailers, POS vendors, and payment processors across the U.S., Canada, and Latin America build a new class of adaptive, data-aware defense.

Ready to rethink loss prevention?

👉 Get a Demo → Get Demo – ArcadianAI

👉 Partner with Us: partnership@arcadian.ai

Security Glossary (2025 Edition)

AI Correlation Engine — A multi-modal model that links POS, payment, and video data to detect contextual anomalies.

ArcadianAI Ranger — Cloud-native AI platform connecting cameras, transactions, and analytics into a unified LP interface.

Chargeback — Customer-initiated reversal of a transaction, often abused for fraudulent refunds.

False Positive — Incorrect identification of legitimate behavior as fraudulent; minimized by contextual AI.

Friendly Fraud — Fraud committed by legitimate customers through misuse of return or payment policies.

NDAA Compliance — U.S. regulation banning certain Chinese surveillance equipment in federal or funded projects.

ONVIF — Open Network Video Interface Forum; standard for IP camera interoperability.

Organized Retail Crime (ORC) — Coordinated theft operations targeting multiple retailers or locations.

Payment Token — Encrypted representation of a card used for secure digital transactions.

POS-Aware Loss Prevention — Integration of transaction and video data to identify context-driven fraud.

Refund Abuse — Fraudulent return of items not purchased or previously used.

Ranger Bridge — ArcadianAI’s onboarding device enabling secure, plug-and-play connection of legacy systems.

Shrink — The difference between recorded inventory and actual stock, caused by theft, error, or fraud.

SOC 2 — Security compliance standard ensuring data integrity and privacy for cloud services.

Sweethearting — Employee collusion to give unauthorized discounts or free items to friends or customers.

Transaction Velocity — Frequency of repeated transactions, used to identify payment fraud.

VMS (Video Management System) — Software for recording and viewing video feeds, often without AI or POS linkage.

VSaaS (Video Surveillance as a Service) — Cloud-based model for remote video storage and analytics.

Void Transaction — Canceled sale processed before settlement; frequent target for fraud manipulation.

Security is like insurance—until you need it, you don’t think about it.

But when something goes wrong? Break-ins, theft, liability claims—suddenly, it’s all you think about.

ArcadianAI upgrades your security to the AI era—no new hardware, no sky-high costs, just smart protection that works.

→ Stop security incidents before they happen

→ Cut security costs without cutting corners

→ Run your business without the worry

Because the best security isn’t reactive—it’s proactive.