The Physical Security Industry in 2025: Markets, Trends and Key Players

The physical security industry is surging past $120 billion in 2025 and is on track to exceed $180 billion by 2029. This post explores who’s leading, regional dynamics, and what’s fueling the expansion.

- Introduction

- Quick Summary / Key Takeaways

- 1. Market Size & Forecasts

- 2. Segment-Specific Markets

- 3. Key Players & Revenue Highlights

- 4. Market Trends & Drivers—With ArcadianAI Edge in Focus

- 5. Competitive Landscape—Who’s Where?

- 6. Strategic Outlook: Why ArcadianAI Must Be Heard

- 7. FAQs for SEO & User Engagement

- Conclusion & Call to Action

Introduction

In today’s high-stakes security industry, the connection between market performance and protective technology has never been clearer. This image captures the essence of that relationship—blending universal security symbols with the momentum of a rising stock market. It reflects the growing economic force behind video surveillance, access control, and guard services, and the investors driving innovation in physical security.

Quick Summary / Key Takeaways

-

Global physical security market: ~$123–147B in 2025; projected to hit $182–216B by 2030.

-

Video surveillance: ~$58–92B in 2025, with AI & IP adoption accelerating.

-

Services segment climbing fast, especially integrated systems and remote monitoring.

-

Top players: Hikvision, Dahua, Axis, Motorola Solutions, Genetec, Allied Universal.

-

Major trends: North America defection from Chinese vendors, cloud/VSaaS growth, executive protection surge, smart city deployments.

1. Market Size & Forecasts

Global Overview

-

The Business Research Company pegs the 2024 global physical security market at $122.5 billion, growing to $129.36 billion in 2025 (CAGR 5.6%), and rising to $182.34 billion by 2029 (CAGR 9.0%) (Wikipedia, Wikipedia).

-

Grand View Research estimates $147.36 billion in 2024, expecting $158.14 billion in 2025, scaling to $216.43 billion by 2030 (CAGR 6.5%) (Grand View Research).

-

Mordor Intelligence forecasts $123.18 billion in 2025, growing to $157.96 billion by 2030 (CAGR 5.1%) (Mordor Intelligence).

-

IMARC Group projects a climb from $131.6 billion in 2024 to $220.4 billion by 2033 (CAGR 5.6%) (IMARC Group).

-

Coherent Market Insights sees $108.39 billion in 2025, reaching $150.6 billion by 2032 (CAGR 4.8%) (Coherent Market Insights).

Conclusion: The industry size ranges from $108–147B in 2025, solidly on path to $180–220B by 2030–33.

Regional Snapshot

-

North America: Estimated at $49.7 billion in 2024, forecast to exceed $108 billion by 2035 (CAGR ~6.7%) (Market Research Future).

-

U.S. only:

-

One source puts it at $30.7 billion (2024), rising to $45.6 billion by 2033 (CAGR 4.5%) (Wikipedia).

-

Another sees $38.42 billion in 2023, reaching $56.8 billion by 2030 (CAGR 5.7%) (Grand View Research).

-

Sector Split: Systems vs Services

-

Mordor reports video surveillance comprises 52.1% of total physical security revenue in 2024; biometric systems grow fastest (CAGR 6.8%). On services, VSaaS leads with 62.2% share, while ACaaS grows fastest (7.1% CAGR) (MarketWatch).

-

Grand View notes services segment is the fastest-growing in U.S. (ACN Newswire).

-

Market.us (2022 figures) shows physical security hit $132.5 billion, with $79.5B systems and $53B services; expected to hit $168B in 2025 and $278B by 2032 (CAGR ~7.9%) (Market.us Scoop).

2. Segment-Specific Markets

Video Surveillance (Hardware & Software)

-

MarketsandMarkets: $57.96 billion in 2025, rising to $88.71 billion by 2030 (CAGR 8.5%) (MarketsandMarkets).

-

Security Today: Noted a slight decline (–0.3%) in 2024 due to China’s –7.8% drop, while “rest of world” grew 4.9%. Total equipment market estimated at $25B in 2024 (Security Today).

Physical Security Services

-

Cognitive Market Research estimates the global services market at $128.915 billion in 2025, with CAGR ~7.8% through 2033 (Cognitive Market Research).

3. Key Players & Revenue Highlights

Global Hardware & Platform Providers

-

Hikvision & Dahua (China): Combined control ~40% of global surveillance camera market (Wikipedia).

-

Axis Communications (Sweden/Canon): Premium brand with global reach; installations at airports, transit systems, enterprise campuses (Wikipedia).

-

Motorola Solutions: Raised forecast to ~$11.65B revenue for 2025 (7.7% growth), thanks to strong demand in education, healthcare, critical infrastructure, AI analytics (Reuters).

-

Axon Enterprise: Updated 2025 revenue guidance of $2.65–2.73B; Q2 revenue hit $668.5M, above expectations (Reuters).

-

Genetec: Japanese-reported revenue is JPY 8.12B (~US$55M) for FY ending March 2025 (13.7% growth) (StockAnalysis); Q1 growth (Y/Y) shown but limited scope (MarketWatch).

Security Service Providers (Manned & Remote)

-

Allied Universal (~US$20B, private) – largest guard services globally.

-

Securitas AB (public, Sweden) ~US$15–16B revenue (Reuters).

-

GardaWorld (private, Canada) – C$13.5B valuation post buyout, but not publicly traded (Reuters).

New & Niche Players

-

Flock Safety (private, USA): ALPR and gunshot detection; in 5,000+ communities; valued at $3.5B in 2022; 10% of U.S. investigations involve their tech (Wikipedia).

-

Vivint (private): ~$400M revenue; home automation/security leader in North America (Security Systems News).

-

Ouster: Not a traditional physical security firm, but its LiDAR sensors support “Physical AI” and smart infrastructure, recording $35M Q2 revenue (+30% YoY) (Investors.com).

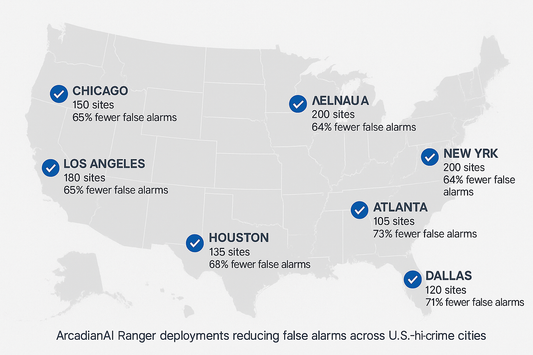

4. Market Trends & Drivers—With ArcadianAI Edge in Focus

1. Shifting Supply Chains & Compliance

-

A post-2024 market decline driven by Chinese downturn (–7.8%) highlights the shift to non-PRC suppliers, especially in North America/EMEA (Security Today).

-

This aligns with ArcadianAI’s positioning as camera-agnostic, supply-chain-secure, and ready to integrate with authorized hardware.

2. VSaaS & Cloud Security Momentum

-

With nearly 63% of services market share in VSaaS, and ACaaS growing fastest (CAGR 7.1%) (Mordor Intelligence), demand is surging for cloud-native analytics platforms—ArcadianAI’s domain.

3. Executive & Corporate Protection Surge

-

U.S. firms doubled spending on executive security in 2024, reaching a median $106,530, with growth in corporate budgets across sectors (Reuters).

-

This reveals high-margin demand segments where ArcadianAI’s real-time analytics and remote vigilance can drive value.

4. Integrated & Smart-Sector Deployments

-

Governments and enterprises increasingly deploy unified video + access control + AI systems in smart cities, campuses, and critical infrastructure.

-

ArcadianAI’s camera-agnostic, interoperable platform is engineered for such environments.

5. Tech-Enabled Guarding & Remote Monitoring

-

Remote monitoring towers and mobile video systems are gaining share—Zedcor in Canada/U.S., and others globally.

-

ArcadianAI can convert legacy guarding spend into scalable, AI-driven remote surveillance services.

5. Competitive Landscape—Who’s Where?

| Player | Approx. 2025 Revenue / Valuation | Notable Strengths & Positioning |

|---|---|---|

| Hikvision & Dahua | Multi-billion USD (dominant camera market share) | Broad, low-cost camera supply; faces compliance scrutiny (Wikipedia) |

| Axis Communications | Private, global premium hardware | Smart infra, IP cameras, enterprise adoption (Wikipedia) |

| Motorola Solutions | ~$11.65 B (2025 expected revenue) | Video + comms + analytics; strong in public safety (Reuters) |

| Axon Enterprise | $2.65–2.73 B (2025 forecast) | Body cams, TASERs, cloud compliance targeting exec security (Reuters) |

| Genetec | ~JPY 8.12 B (~US$55M) FY 2025 | VMS leader, unified software stack; public/global (StockAnalysis) |

| Allied Universal / Securitas | ~$16–20 B (guard services) | Largest manned security; expanding with tech integration |

| GardaWorld | C$13.5 B valuation (private) | Large-scale guarding in Canada, tech-guarding hybrids (Reuters) |

| Flock Safety | Valued $3.5 B; expanding | ALPR, community focus, law enforcement integration (Wikipedia) |

| Vivint | ~$400 M revenue | Home automation and security in North America (Security Systems News) |

| Ouster | $35 M Q2 revenue (+30% YoY) | LiDAR for physical AI, smart cities, logistics (Investors.com) |

6. Strategic Outlook: Why ArcadianAI Must Be Heard

-

Seize VSaaS and cloud-first momentum as legacy hardware suppliers plateau.

-

Offer secure, non-PRC-ready options, meeting regulatory needs across NA and EMEA.

-

Expand into high-margin executive security, leveraging AI insights for real-time protection.

-

Target smart-city and integrated systems, from campuses to transportation.

-

Convert guarding spend into smarter remote services, with RVMS or mobile monitoring bundle offerings.

7. FAQs for SEO & User Engagement

-

What is the current size of the physical security market worldwide?

Global estimates range from $108 billion–$147 billion in 2025, depending on scope. (Sources: Business Research, Mordor, Grand View) (thebusinessresearchcompany.com, Grand View Research, Mordor Intelligence) -

How fast is the physical security market growing?

CAGR projections vary from ~5% to 7%, with some forecasts reaching ~9% through 2030. (thebusinessresearchcompany.com, Grand View Research, MarketsandMarkets) -

Which segment of physical security is expanding fastest?

VSaaS and ACaaS are the highest growth services; biometric systems also show strong gains. (Mordor Intelligence) -

Who are the top players in video surveillance globally?

Leading hardware vendors include Hikvision, Dahua, Axis, Motorola Solutions, and Axon; notable software platforms include Genetec. (Wikipedia, Reuters, StockAnalysis) -

What’s happening with security services providers?

Companies like Allied Universal and Securitas dominate manned security; GardaWorld remains private but highly valued at C$13.5B. (Reuters)

Conclusion & Call to Action

With the physical security market primed for explosive growth—topping $180 billion by 2029 and beyond—now’s the moment for ArcadianAI to turn heads, drive disruption, and redefine remote, AI-first surveillance.

See ArcadianAI in Action → Get Demo – ArcadianAI

Security is like insurance—until you need it, you don’t think about it.

But when something goes wrong? Break-ins, theft, liability claims—suddenly, it’s all you think about.

ArcadianAI upgrades your security to the AI era—no new hardware, no sky-high costs, just smart protection that works.

→ Stop security incidents before they happen

→ Cut security costs without cutting corners

→ Run your business without the worry

Because the best security isn’t reactive—it’s proactive.