The Truth Behind the Global Camera Market

Millions of cameras are watching the world—but do you really know who built them? This post uncovers the real manufacturers, OEM myths, NDAA truths, and the future of surveillance tech.

- Introduction

- Quick Summary / Key Takeaways

- Background & Relevance

- Global Surveillance Camera Stats by Country

- Top Camera Manufacturers (OEM & Brands)

- Manufacturing Capacity by Country

- OEM, Rebranding & Brand Deception

- NDAA, Compliance & Ethical Manufacturing

- Standards, Certifications, and Regional Laws

- The Future of Surveillance Camera Production

- Conclusion & CTA

Who Makes Your Security Camera and Why It Matters

Meta Description: Uncover where surveillance cameras are made, who really manufactures them, and how global OEM deals are reshaping security, compliance, and trust.

Excerpt: Millions of cameras are watching the world—but do you really know who built them? This post uncovers the real manufacturers, OEM myths, NDAA truths, and the future of surveillance tech.

Introduction

If you own a security camera, chances are it wasn't built by the brand on the box.

Today, surveillance cameras are everywhere: homes, schools, retail stores, factories, police stations, and entire smart cities. Yet most people are unaware that behind popular brand names like Lorex, Swann, Ring, Verkada, or even Telus and ADT, there's often a hidden manufacturer—usually located in China or Southeast Asia—doing the actual production.

This blog post takes a deep dive into the global camera landscape: from which countries have the most cameras, to who really manufactures them, to how branding, regulation, and geopolitics are changing the game.

We’ll reveal the truth behind OEM (Original Equipment Manufacturer) partnerships, the role of China in manufacturing, what NDAA compliance means, and how it impacts businesses and governments around the world.

Whether you're a business owner, security professional, government buyer, or just someone trying to understand where your tech comes from—this is your ultimate guide.

Quick Summary / Key Takeaways

-

China dominates both camera production and global distribution, supplying parts or full devices for most global brands.

-

Most popular security camera brands in North America are rebranded OEMs with little to no in-house manufacturing.

-

NDAA compliance is reshaping government and enterprise procurement by banning specific Chinese-origin tech.

-

Brand deception is widespread: many Western brands sell Chinese-made devices under "safe" labels.

-

The future of surveillance manufacturing may shift to Vietnam, India, and Mexico—but China still leads.

Background & Relevance

Global surveillance camera usage has exploded over the last decade. According to data from IHS Markit and Comparitech:

-

Over 1 billion cameras are installed worldwide as of 2025.

-

China alone accounts for more than 600 million (60%).

-

The U.S. has about 85 million, with rapid growth in smart home and retail sectors.

While mass adoption helps improve security, reduce theft, and monitor public spaces, the opacity behind who actually manufactures these devices poses serious security, compliance, and ethical risks.

The issue gained geopolitical importance after the U.S. passed the National Defense Authorization Act (NDAA), banning the use of certain Chinese surveillance technologies in federal and military settings. That move exposed the fact that many Western-branded cameras were still made by banned entities like Hikvision and Dahua, often without consumers knowing.

Global Surveillance Camera Stats by Country

| Country | Estimated Cameras (2025) | Public Sector | Private Sector | Home Use |

|---|---|---|---|---|

| China | 600M+ | 400M+ | 150M | 50M |

| United States | 85M | 10M | 55M | 20M |

| India | 70M | 20M | 40M | 10M |

| UK | 15M | 5M | 7M | 3M |

| Russia | 14M | 6M | 6M | 2M |

| Brazil | 12M | 2M | 7M | 3M |

| Canada | 10M | 1.5M | 6.5M | 2M |

| Australia | 9M | 1M | 6M | 2M |

| Germany | 8M | 1M | 5M | 2M |

| Mexico | 6M | 1M | 4M | 1M |

Source: Statista, Comparitech, Frost & Sullivan

Top Camera Manufacturers (OEM & Brands)

Major OEMs (Behind the Scenes)

| Manufacturer | Country | Known Clients / Brands |

|---|---|---|

| Hikvision | China | Lorex, Ezviz, some rebranded systems |

| Dahua Technology | China | Amcrest, LaView, Swann (some models) |

| Uniview | China | OEM to many unbranded white-label systems |

| Tiandy | China | Government/City contracts, OEM clients |

| Vivotek (Delta) | Taiwan | OEM for some Western brands |

| OEM in Vietnam | Vietnam | Used by Ring, Wyze, other rebrands |

| Foxconn | China | Manufacturing partner to multiple tech firms |

Popular Brands (Not Actual Manufacturers)

-

Lorex: Uses Dahua OEM parts (now owned by Taiwan-based Skywatch)

-

Swann: Mostly OEM from China (varies by model)

-

LaView: Dahua OEM

-

ADT: Uses rebranded Hikvision and OEM gear for Blue by ADT

-

Verkada: Assembles in U.S. but PCB and lenses sourced from China

-

Ring (Amazon): Production outsourced to Southeast Asia (Vietnam, Malaysia), designed in U.S.

-

Eufy (Anker): Chinese-owned, self-manufactured

-

Wyze: White-labeled from Chinese OEMs

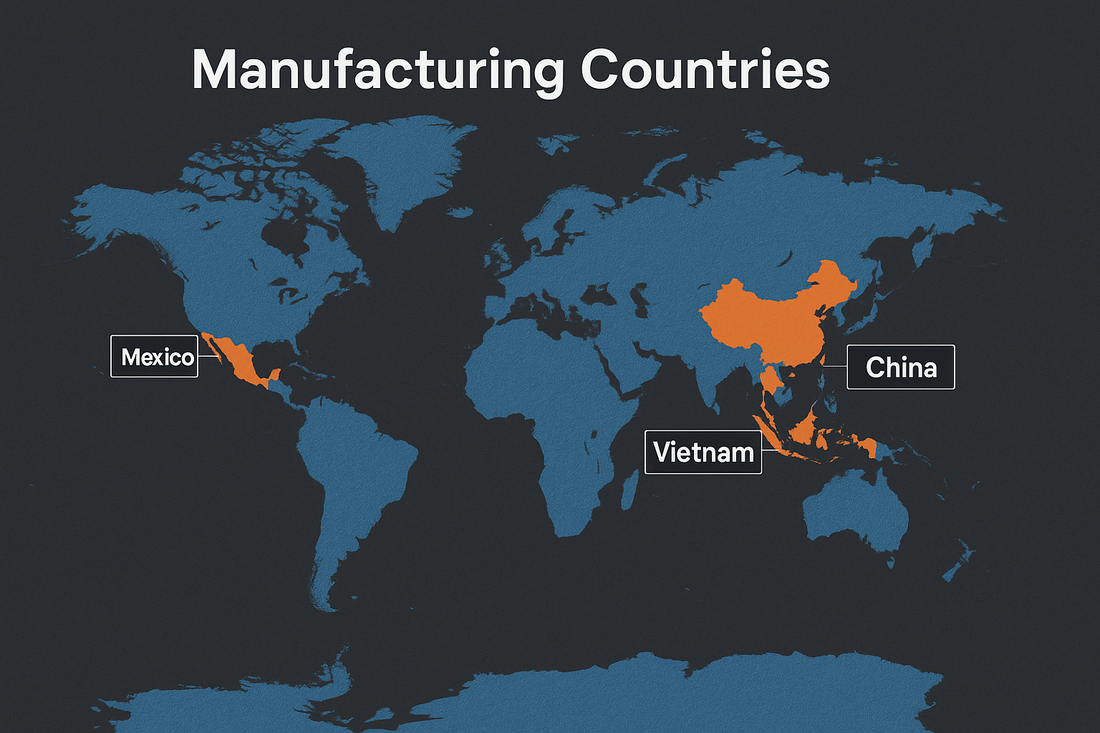

Manufacturing Capacity by Country

| Country | Annual Camera Production Capacity | Main Focus Areas |

|---|---|---|

| China | 800M+ units | Full-stack production, all sectors |

| Vietnam | 80M+ units | Smart home, retail, residential |

| Taiwan | 50M+ units | Enterprise-grade, industrial |

| South Korea | 30M units | Advanced optics, automotive |

| Mexico | 20M units | U.S. exports, assembly lines |

| USA | 10M units | High-cost manufacturing, military-use |

Observation: Nearly 90% of global cameras are manufactured in or involve supply chains from China.

OEM, Rebranding & Brand Deception

Most consumers and even resellers are unaware that many "brands" do not actually design or manufacture their own products. Here’s how it works:

-

OEM Manufacturer: Makes the camera hardware (e.g., Hikvision, Dahua).

-

Rebranding Company: Slaps their logo on it (e.g., Lorex, Swann, ADT).

-

Reseller or Retailer: Markets it as a secure, U.S./Canadian product.

This process creates layers of confusion and obscures the origin of the device. Even well-known telecom providers like Telus, Bell, and Comcast often offer OEM solutions labeled as proprietary services.

NDAA, Compliance & Ethical Manufacturing

The U.S. government enacted Section 889 of the 2019 NDAA to prohibit federal use of certain Chinese surveillance products due to national security concerns.

NDAA-Banned Companies

-

Hikvision

-

Dahua

-

Huawei

-

ZTE

-

Hytera

NDAA-Compliant Alternatives

| Brand | Manufacturing Location | Compliance | Notes |

|---|---|---|---|

| Axis | Sweden | Yes | High-quality enterprise systems |

| Hanwha Vision | South Korea | Yes | Formerly Samsung Techwin |

| Avigilon | Canada / Mexico | Yes | Owned by Motorola Solutions |

| Verkada | U.S. (partial) | Mixed | Not NDAA-approved for all models |

| Bosch | Germany / China | Mixed | Needs SKU verification |

Real-World Impact

Many government contractors and infrastructure providers were forced to rip and replace systems when NDAA regulations were enforced. This reshaped vendor evaluation and forced businesses to dig into the supply chain.

Standards, Certifications, and Regional Laws

| Certification / Standard | Region | What It Covers |

|---|---|---|

| NDAA (889) | USA | Bans use of certain Chinese vendors |

| ONVIF | Global | Interoperability for IP-based video systems |

| FCC Part 15 | USA | Radiofrequency device compliance |

| CE Mark | Europe | EU health, safety, and environmental standards |

| CCC | China | National China Compulsory Certification |

| UL / CSA | North America | Safety, fire protection, power standards |

| GDPR | Europe | Data privacy for video and AI analytics |

The Future of Surveillance Camera Production

Several trends are shaping the next decade of surveillance manufacturing:

-

Vietnam & India Rising: U.S.-China trade tensions are pushing brands to seek alternative production hubs.

-

Secure-by-Design Cameras: NDAA compliance is forcing a redesign of supply chains and firmware validation.

-

Edge AI Capabilities: Demand is rising for on-device analytics to reduce cloud costs and latency.

-

Environmental Compliance: Manufacturing is becoming greener to meet ESG goals and EU regulations.

-

Microfactories in North America: A niche but growing interest in localized assembly for enterprise and military.

Conclusion & CTA

The global camera market is more complex than it appears. While the brand may say "designed in USA" or "trusted by Canadians," the components, firmware, and even the entire camera may have originated in Shenzhen.

Understanding where your camera comes from isn't just a supply chain issue—it's a matter of compliance, privacy, and security.

ArcadianAI is committed to transparency, NDAA compliance, and AI-first intelligence built on trust.

👉 Want to secure your business with trusted, compliant, AI-powered surveillance?

Book a demo with ArcadianAI

Security is like insurance—until you need it, you don’t think about it.

But when something goes wrong? Break-ins, theft, liability claims—suddenly, it’s all you think about.

ArcadianAI upgrades your security to the AI era—no new hardware, no sky-high costs, just smart protection that works.

→ Stop security incidents before they happen

→ Cut security costs without cutting corners

→ Run your business without the worry

Because the best security isn’t reactive—it’s proactive.